Multifamily Brokerage Services

We anticipate trends, identify opportunities, and manage risks that lead to rewarding client decisions.

SALES and ADVISORY SERVICES

MARKET RESEARCH and TREND ANALYSIS

VALUATIONS and FINANCIAL ANALYSIS

MULTI-FAMILY FINANCING/LENDING/LOANS

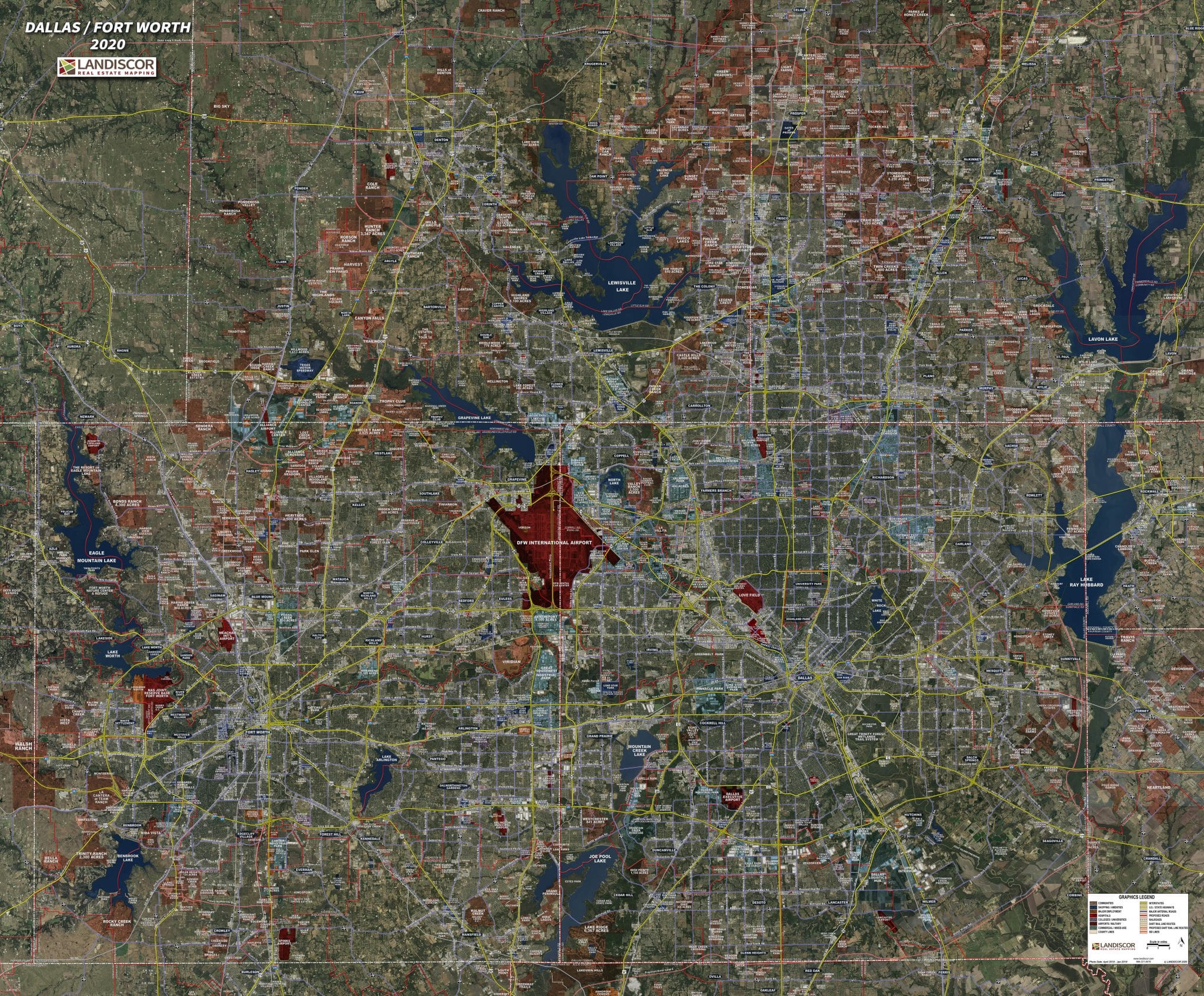

DFW Multifamily Real Estate Consultants

Our Multifamily Brokerage Team has an impeccable track record of success in the multifamily acquisition and disposition of multi-housing properties for its clients through information analysis, risk identification and strategic financing strategies. We have successfully conducted billions of dollars multi-housing sales and advisory services through a proven, systematic process that ensures smooth and speedy transitions from Advisory to Investment Sales to Capital Services and Closing.

We value long-term client relationships which require working at all ends of the multi-family property spectrum. As such, we don’t discriminate based upon size (large or small). Our team routinely works on properties ranging in scope and scale from a small apartment property in a tertiary market to large institutional caliber multi-state portfolios.

Apartment Sales and Advisory Services

- Seller representation

- Buyer representation

- Acquisition and Disposition

- Individual property and portfolio sales

- Purchase and Sale Due Diligence

- Optimum use studies

- Hold / Sell Analysis

- Mergers & Acquisitions

- 1031 tax-deferred exchanges

- Succession planning for families and businesses

- Dissolution of marital assets and allocation of holdings

DFW Market Research and Trend Analysis

- Occupancy cost reviews

- Development Proformas

- Market research surveys, trends and analysis

- Economic & Demographic Trends Research

- Asset marketing and research services

- Supply and demand analysis

- Economic Overviews, Forecasting and Trends

- Economic and market research

- Public sector repositioning strategies

- Multi-housing Opportunity Zone Investing

- Demographic studies and reports

- Feasibility studies

BPOs, Valuations and Financial Analysis

- Apartment Underwriting Services

- Property Valuations / Evaluations

- Land development analysis

- Asset repositioning feasibility analysis

- Analyzing partnership structures

- Feasibility Studies and Proforma Analysis

- Valuation and appraisal services

- Multifamily property valuations

- Fiscal impact reports

- SFR Portfolio Valuations

- Broker Price Opinion

- Broker Opinion of Valuation

- Portfolio analysis

- Realty tax appeals

The 4 Types of 1031 Property Exchanges

Delayed 1031 Exchange

The most common. Delayed Exchanges occur when the original property is relinquished before acquiring the replacement property.

Simultaneous 1031 Exchange

Simultaneous exchanges are when the relinquished property and the replacement property close on the same day. Requires expert excution.

Construction 1031 Exchange

Funds improvements to the replacement property by using tax-deferred dollars while held by a qualified intermediary for the a 180 day exchange period.

Reverse 1031 Exchange

Requires all cash to buy the replacement property through an exchange accommodation titleholder before exchanging the relinquished apartment